Pascoes_barber

Well-known member

You’re unaware that there are already many thousands of “non-citizens” eligible to vote (PRs from the UK mostly)?What unique benefits does Australian Citizenship include?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You’re unaware that there are already many thousands of “non-citizens” eligible to vote (PRs from the UK mostly)?What unique benefits does Australian Citizenship include?

No I’m not.You’re unaware that there are already many thousands of “non-citizens” eligible to vote (PRs from the UK mostly)?

Only citizens can vote.You’re unaware that there are already many thousands of “non-citizens” eligible to vote (PRs from the UK mostly)?

And permanent residence holding British Citizenships

Only if they were enrolled prior to 1984. If not, they cant voteAnd permanent residence holding British Citizenships

Funny if Hawkie changed it.Only if they were enrolled prior to 1984. If not, they cant vote

Funny if Hawkie changed it.

Can't argue with this.Any adult who has lived in Australia for more than 10 years should be an Australian citizen and if not you shouldn't be allowed to vote no matter where you came from.Everybody should be treated the same with no exceptions

The problems facing the UK now and the US (to a lesser extent Australia) in 6 to 9 months are literally the opposite to Reagan/Thatcher/Hawke/Keating/Keynesian economics. UK and US are suffering from massive inflation due to massive overspending, poor fiscal policy (initially understandable due to Covid) pumping trillions into an overheated economy. The unavoidable consequence of pumping cash into a hot economy is always rampant inflation and that is what is happening now.

If spending isn’t reeled in (it’s not) the only remedy is massive increases in interest rates. Where the rubber hits the road is that these economies (as well as ours) are addicted to debt and now the interest rates on that debt will cripple them and us.

This current pain is because it is now time to pay the piper. For years now progressive governments tell us that “modern monetary policy” is the way to go and there is nothing wrong with a deficit, well here come the fruits of that ideology. Debts need to be paid on increased interest due to poor fiscal and monetary policy for decades.

LITERALLY the opposite of Reagan and Thatcher. What the world needs right now is a Reagan/Thatcher/Hawke/keating keynesian approach but it is too late and our kids will pay the price.

Keating had too much influence over RBA monetary policy.The problems facing the UK now and the US (to a lesser extent Australia) in 6 to 9 months are literally the opposite to Reagan/Thatcher/Hawke/Keating/Keynesian economics. UK and US are suffering from massive inflation due to massive overspending, poor fiscal policy (initially understandable due to Covid) pumping trillions into an overheated economy. The unavoidable consequence of pumping cash into a hot economy is always rampant inflation and that is what is happening now.

If spending isn’t reeled in (it’s not) the only remedy is massive increases in interest rates. Where the rubber hits the road is that these economies (as well as ours) are addicted to debt and now the interest rates on that debt will cripple them and us.

This current pain is because it is now time to pay the piper. For years now progressive governments tell us that “modern monetary policy” is the way to go and there is nothing wrong with a deficit, well here come the fruits of that ideology. Debts need to be paid on increased interest due to poor fiscal and monetary policy for decades.

LITERALLY the opposite of Reagan and Thatcher. What the world needs right now is a Reagan/Thatcher/Hawke/keating keynesian approach but it is too late and our kids will pay the price.

Very good article.

Aukus will lock in Australia’s dependence on US, intelligence expert warns

Clinton Fernandes argues in provocative new book the security pact will make it impossible to have an independent defence policywww.theguardian.com

Keating had too much influence over RBA monetary

Uk problems right now have nothing to do with Brexit. It is rampant inflation caused by pumping cash into an overheating economy and the energy squeeze. The reason the sterling dived and govt had to by back bonds is debt repayments at high interest rates. Nothing to do with Brexit.Keynesian economics and the Reagan/Thatcher model familiarities are much more of the chalk and cheese variety, rather than bedfellows.

The current UK and US situations (and here too to a lesser extent) are very different, with the post Brexit paralysis like affect in the UK causing much of their pain. Pain now only getting worse with the latest policies.

Plenty of irony in that Thatcher was a strong supporter of joining the EU (one of her few quality opinions), that countries and governments from that union and elsewhere, own so much of the infrastructure that she privatised.

Uk problems right now have nothing to do with Brexit. It is rampant inflation caused by pumping cash into an overheating economy and the energy squeeze. The reason the sterling dived and govt had to by back bonds is debt repayments at high interest rates. Nothing to do with Brexit.

Nope……no effect at all. UK GDP reset very quickly and has continued steady slow growth.4% odd loss in GDP has no effect hey? Even a cursory look at the difference between the Ireland portion of the economy that remained part of the EU trade zone, compared with that of the remainder of kingdom, clearly shows it.

Mate not everything fits neatly in your anti conservative world view. Reality always wins and bites hard.Also, my initial post was on the ridiculous policy decision-making of the latest iteration of the Tory government, their appointment being the final act of the Queen, and the results of them. Apart from the covid injection of funds, along with severe rorting involved, the UK economic rationale has been that of austerity throughout the 12 year tenure of this government.

complete rubbish. Interest rates have risen sharply to counter inflation. The high rates are now biting due to massive debt incurred by Labour.Their borrowing rates rose substantially on the back of and to central banking reaction to such policies, not prior to them.

Nope……no effect at all. UK GDP reset very quickly and has continued steady slow growth.

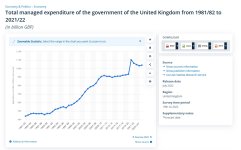

View attachment 2767

Mate not everything fits neatly in your anti conservative world view. Reality always wins and bites hard.

inflation is currently at 10% in UK. Directly a result of too much money pumped into a hot economy. Interest rates have risen 2% in 9months.

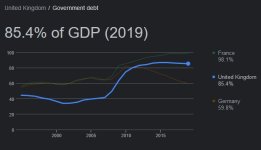

As far as “Austerity” is concerned, the UK Government has slowed But not decreased spending (Covid) excluded but they had to after Labour spent like drunkard sailors for 13 years. Look at this graph. What happened between 97-2010? At the start of Tony Blair’s government debt was 40% of GDP.. By the time Labour got kicked out it was 83% of GDP. After 12years of conservative government the debt is steady at 85%..

View attachment 2768

complete rubbish. Interest rates have risen sharply to counter inflation. The high rates are now biting due to massive debt incurred by Labour.

economics and mathematics bow to no ideology. Reality bites.

View attachment 2769

Facts🔥🔥🔥🔥Haha, you're a wild boy using

Those graphs to prove your point

Facts🔥🔥🔥🔥